Building Effective Financial Strategies for Business Stability 3534549822

The construction of effective financial strategies is crucial for maintaining business stability amid fluctuating economic conditions. It requires a meticulous approach to financial planning, emphasizing long-term objectives and risk mitigation. By integrating diverse investment portfolios and managing cash flow adeptly, organizations can improve their resilience. Understanding these components is essential for navigating market volatility. However, the question remains: how can businesses align their resources strategically to not only survive but thrive in an ever-changing landscape?

Understanding the Importance of Financial Planning

Although many businesses prioritize immediate operational needs, the significance of financial planning cannot be overstated.

Establishing clear financial goals and conducting thorough risk assessments are crucial for long-term stability. By strategically aligning resources and anticipating potential challenges, businesses can navigate uncertainties with greater confidence.

This proactive approach not only secures freedom from unforeseen financial burdens but also fosters sustainable growth in a competitive landscape.

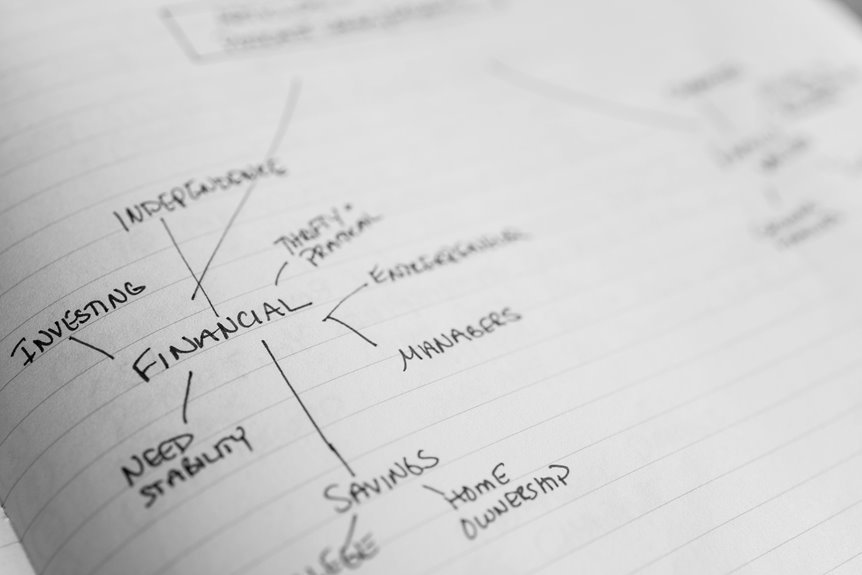

Key Components of a Resilient Financial Strategy

What elements constitute a resilient financial strategy for businesses aiming to thrive in fluctuating markets?

Critical components include thorough risk assessment to identify vulnerabilities and potential threats, alongside investment diversification to mitigate losses across various sectors.

Such strategies enable organizations to adapt dynamically to economic shifts, ensuring long-term stability and growth while allowing the freedom to seize emerging opportunities without compromising financial integrity.

Strategies for Effective Cash Flow Management

Effective cash flow management is essential for businesses seeking to maintain operational stability and capitalize on growth opportunities.

By diligently tracking expenses, companies can identify areas for cost reduction while optimizing cash reserves.

Implementing a robust cash flow forecasting model enables proactive decision-making, ensuring liquidity during fluctuations.

This strategic approach empowers businesses to navigate challenges while seizing opportunities for expansion and innovation.

Adapting to Economic Changes and Market Trends

How can businesses remain resilient in an ever-evolving economic landscape?

Effective adaptation hinges on thorough economic forecasting and market analysis. By continuously evaluating trends and consumer behaviors, companies can pivot strategies to align with shifting demands.

This proactive approach not only mitigates risks but also uncovers new opportunities, empowering businesses to thrive amidst uncertainty and maintain a competitive edge in their respective markets.

Conclusion

In conclusion, effective financial strategies are crucial for business stability, particularly in navigating economic uncertainties. Notably, research indicates that companies with robust financial planning are 30% more likely to survive economic downturns compared to those without. By prioritizing long-term goals, diversifying investments, and optimizing cash flow, organizations can enhance resilience and capitalize on emerging opportunities. This analytical approach not only safeguards financial integrity but also positions businesses to thrive in an increasingly competitive landscape.