Driving Profitability Through Smart Financial Strategies 3801981766

Driving profitability requires a strategic approach to financial management. Organizations must integrate technology to streamline processes and enhance efficiency. A robust budgeting strategy is essential for allocating resources effectively. Furthermore, analyzing financial data enables informed decision-making, while fostering a culture of accountability aligns employee actions with overarching goals. These elements are crucial for achieving sustainable growth. However, the interplay between these strategies raises essential questions about their implementation and long-term impact.

Embracing Technology for Financial Efficiency

As technology continues to evolve, individuals and businesses alike must recognize its potential to enhance financial efficiency.

Automated invoicing streamlines payment processes, reducing administrative burdens and accelerating cash flow.

Meanwhile, digital expense tracking provides real-time insights into spending patterns, enabling informed decision-making.

Crafting a Robust Budgeting Strategy

A well-structured budgeting strategy serves as the cornerstone of financial stability and growth for both individuals and organizations.

Effective budgeting techniques, such as zero-based budgeting and incremental planning, enhance expense forecasting accuracy, allowing for informed resource allocation.

Analyzing Financial Data for Informed Decision-Making

Harnessing financial data transforms decision-making processes, enabling organizations to operate with greater precision and foresight.

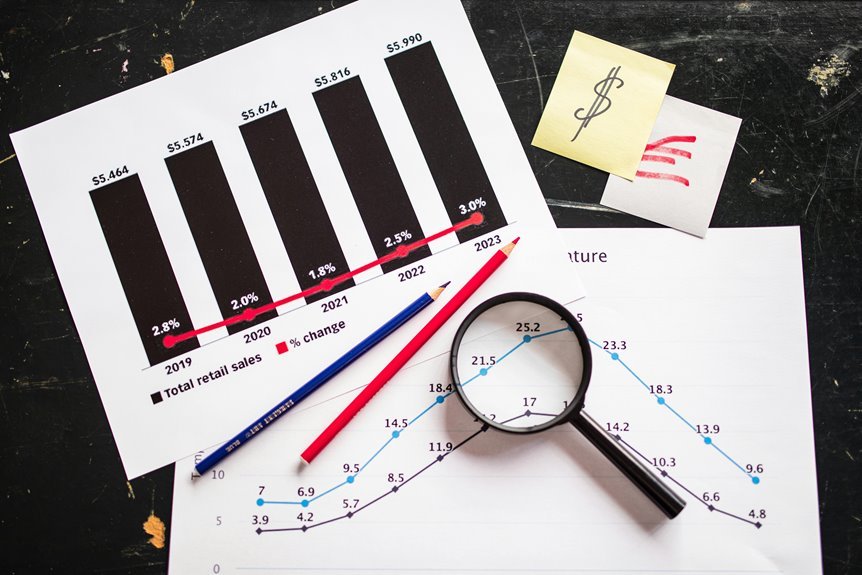

Through effective financial forecasting and data visualization, companies can identify trends and make informed choices. This analytical approach allows leaders to mitigate risks and capitalize on opportunities, fostering an environment where strategic decisions are data-driven.

Ultimately, informed decision-making enhances organizational agility and promotes sustained profitability.

Cultivating a Culture of Financial Accountability

Effective decision-making, underpinned by robust financial data analysis, sets the stage for cultivating a culture of financial accountability within organizations.

Implementing comprehensive financial training equips employees with essential skills to understand and manage financial metrics.

Coupled with accountability measures, this approach fosters transparency, encourages responsible behavior, and aligns individual actions with broader organizational goals, ultimately driving sustainable profitability and operational freedom.

Conclusion

In conclusion, the integration of technology, strategic budgeting, and data analysis is not just a recipe for success; it is the golden key that unlocks the vault of profitability. By fostering a culture of financial accountability, organizations empower their teams to act with purpose and precision. As businesses navigate the competitive landscape, these smart financial strategies will not merely enhance operations—they will catapult them to unprecedented heights of financial success, ensuring sustainable growth in an ever-evolving market.