Optimizing Financial Operations for Business Stability 3533766850

Optimizing financial operations is a critical endeavor for businesses aiming for stability. It requires a thorough assessment of existing processes to identify inefficiencies. Furthermore, integrating technology solutions can significantly enhance operational effectiveness. Financial reporting and analysis play a vital role in understanding performance metrics. However, the challenge lies in maintaining a continuous improvement culture that adapts to changing market dynamics. This strategic approach may hold the key to long-term resilience. What specific steps can organizations take to achieve this?

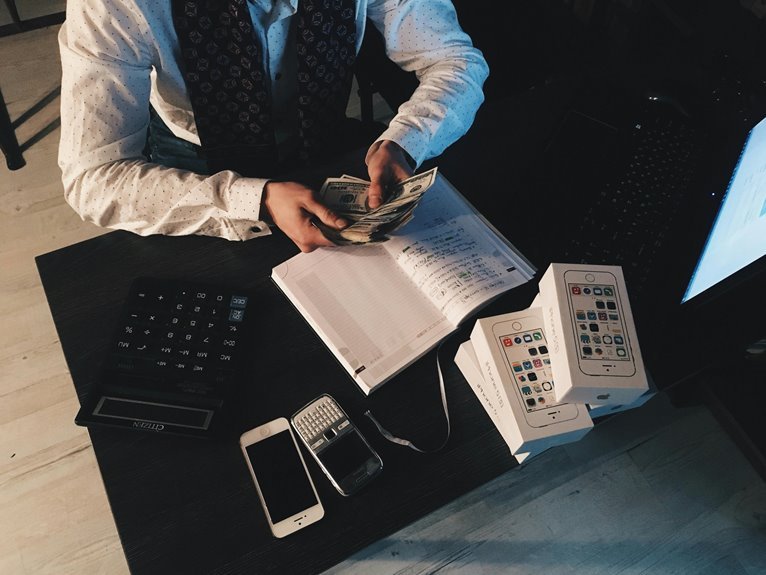

Assessing Current Financial Processes

How effectively are organizations managing their financial processes? A thorough process evaluation reveals discrepancies in efficiency and effectiveness, often masked by surface-level metrics.

Engaging in detailed cost analysis allows leaders to identify waste and optimize resource allocation. By scrutinizing current practices, organizations can enhance financial stability, ultimately empowering them to pursue opportunities and navigate challenges with greater agility and freedom.

Implementing Technology Solutions

An evaluation of current financial processes often uncovers opportunities for improvement through the integration of technology solutions.

Embracing cloud accounting enhances accessibility and real-time data management, empowering businesses to streamline operations.

Meanwhile, mobile invoicing facilitates quicker transactions, reducing delays and enhancing cash flow.

Together, these solutions promote operational efficiency, allowing businesses to focus on growth while maintaining financial stability and flexibility.

Enhancing Financial Reporting and Analysis

While many organizations prioritize operational efficiency, enhancing financial reporting and analysis is equally crucial for informed decision-making and strategic planning.

Accurate financial metrics provide insights into performance, enabling leaders to assess risk and identify growth opportunities.

Continuous Improvement and Adaptation Strategies

Embracing continuous improvement and adaptation strategies is essential for organizations seeking to thrive in an ever-evolving financial landscape.

By implementing lean methodologies, businesses can streamline processes and eliminate waste, enhancing efficiency.

Meanwhile, agile practices facilitate responsiveness to market changes, enabling firms to pivot swiftly.

Collectively, these strategies foster a culture of innovation, ensuring resilience and long-term stability in financial operations.

Conclusion

In conclusion, optimizing financial operations significantly contributes to business stability by enhancing efficiency and resource allocation. A study by Deloitte reveals that organizations implementing cloud-based accounting solutions can reduce financial close processes by up to 50%. This statistic underscores the transformative impact of technology on financial management. By continuously assessing practices and fostering a culture of innovation, businesses can adapt to market changes effectively, ensuring resilience and alignment with long-term strategic objectives.