Optimizing Financial Operations for Business Stability 3533766850

In today’s volatile market landscape, optimizing financial operations is crucial for maintaining business stability. Streamlining processes can significantly enhance cash flow management and ensure liquidity. Moreover, the integration of technology solutions minimizes errors and provides real-time insights. However, organizations must also consider regular risk assessments and investment strategies to mitigate potential financial pitfalls. The interplay of these factors raises important questions about the sustainability and resilience of financial practices in an ever-evolving environment.

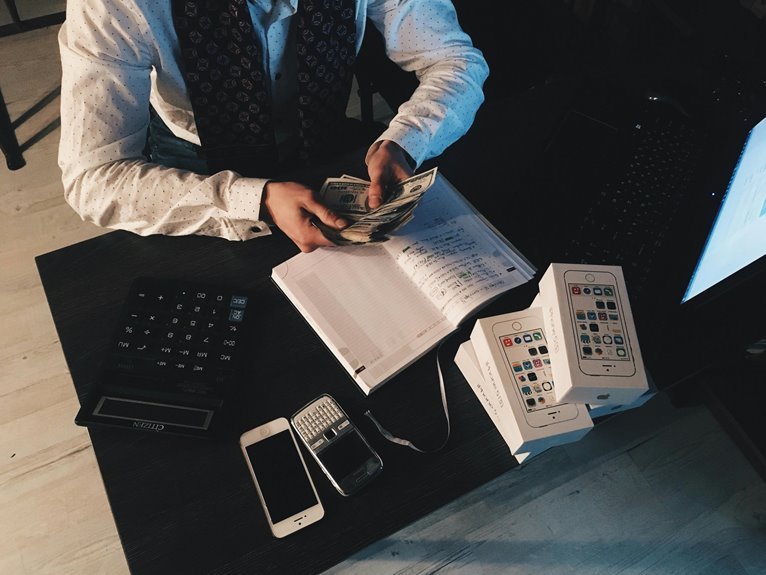

Streamlining Financial Processes

Although financial processes are essential for business operations, many organizations struggle with inefficiencies that hinder overall performance.

Streamlining these processes involves enhancing financial forecasting and optimizing budget allocation. By adopting precise methodologies, companies can improve resource distribution, anticipate future financial conditions more accurately, and ultimately foster a more agile operational environment.

This strategic focus empowers organizations to achieve greater financial freedom and stability.

Enhancing Cash Flow Management

How can businesses effectively enhance their cash flow management to ensure long-term sustainability?

Implementing robust cash forecasting techniques allows organizations to anticipate financial needs accurately.

Coupled with strategic payment strategies, such as optimizing invoicing schedules and negotiating payment terms, businesses can maintain liquidity and support growth.

Minimizing Financial Risks

Effective cash flow management lays the groundwork for minimizing financial risks by providing businesses with a clearer understanding of their financial landscape.

Conducting regular risk assessments enables organizations to identify vulnerabilities, while investment diversification safeguards against potential losses.

Implementing Technology Solutions

As businesses seek to enhance their financial operations, the integration of technology solutions emerges as a pivotal strategy.

Utilizing cloud accounting allows for real-time financial insights, fostering informed decision-making. Additionally, automated invoicing streamlines billing processes, reducing errors and improving cash flow.

Collectively, these technological advancements not only enhance operational efficiency but also empower businesses to maintain stability in dynamic markets.

Conclusion

In conclusion, optimizing financial operations is crucial for fostering business stability in a volatile market. As the adage goes, “A stitch in time saves nine,” emphasizing the importance of proactive measures. By streamlining processes, enhancing cash flow management, and embracing technology, organizations can mitigate risks and position themselves for sustainable growth. Ultimately, a strategic focus on these areas not only safeguards against financial instability but also enhances overall performance, ensuring resilience in an ever-changing landscape.