Building Financial Stability Through Strategic Planning 3298384815

Strategic planning is essential for achieving financial stability within organizations. It provides a structured approach to defining objectives and allocating resources effectively. By assessing risks and fostering team engagement, organizations can remain adaptable in uncertain environments. However, the challenge lies in consistently measuring success and making timely adjustments. Understanding how to navigate these complexities can significantly influence long-term financial outcomes, prompting a deeper exploration into the intricacies of strategic planning.

Understanding the Importance of Strategic Planning

While many organizations may perceive strategic planning as merely an administrative task, its true value lies in its ability to establish a clear roadmap for financial stability.

Effective financial forecasting and thorough risk assessment are integral components that empower organizations to navigate uncertainties.

Key Components of a Successful Strategic Plan

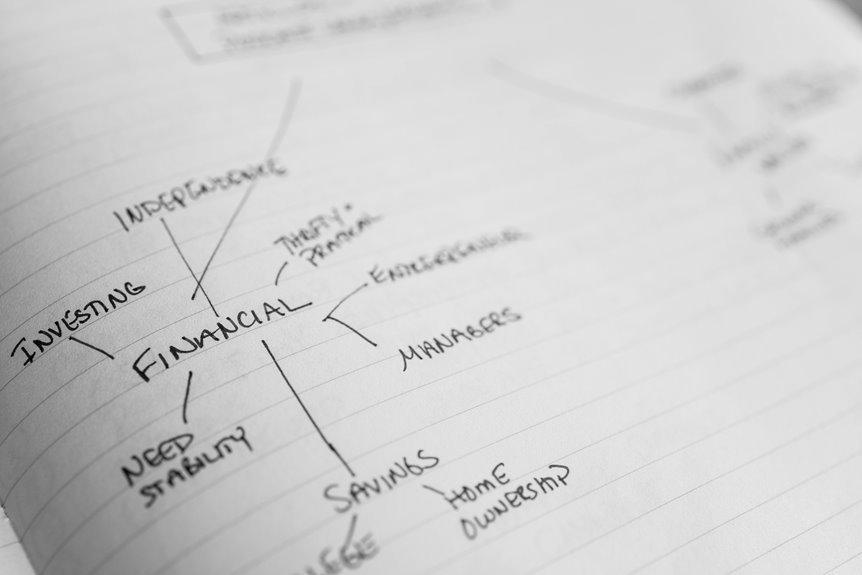

A successful strategic plan is built upon several key components that collectively drive an organization toward its financial goals.

Goal setting establishes clear objectives, guiding the organization’s direction.

Effective resource allocation ensures that financial and human capital are utilized efficiently, maximizing impact.

Together, these components foster a disciplined approach, enabling the organization to adapt and thrive in a competitive landscape while pursuing long-term stability.

Implementing Your Strategic Plan Effectively

Effective implementation of a strategic plan is critical for translating vision into actionable outcomes.

Successful execution hinges on precise resource allocation, ensuring that personnel and financial assets align with strategic goals.

Additionally, fostering team engagement is essential, as motivated employees enhance collaboration and innovation.

Measuring Success and Adjusting Your Strategy

Measuring success is vital for organizations to evaluate the effectiveness of their strategic plan and make informed adjustments.

By establishing clear success metrics, organizations can objectively assess performance and identify areas for improvement.

Regularly reviewing these metrics allows for timely strategy adjustments, ensuring alignment with goals and fostering resilience.

This analytical approach empowers organizations to navigate challenges while advancing toward financial stability and autonomy.

Conclusion

In conclusion, strategic planning serves as a crucial framework for achieving financial stability, countering the misconception that it is merely a bureaucratic exercise. By emphasizing clear objectives, resource optimization, and adaptive risk management, organizations can cultivate resilience in uncertain environments. Regular assessments and adjustments to the strategic plan enhance its effectiveness, ensuring alignment with evolving market conditions. Ultimately, a well-executed strategic plan not only secures financial health but also fosters an innovative culture that drives long-term success.